Since the dawn of civilization, we have managed to escape many physical barriers of nature. With enough money – a human construct devoid of any physical worth – one can buy the essentials to cover all their basic needs. Yet our bodies exemplify the intangible nature of money: for instance, the fruits of physical exercise, such as a healthier and longer lifespan on average, can only be reaped through effort and cannot be bought. Nonetheless, a debate arises when considering the advantages that financial resources can bring, such as access to health supplements or advanced exercise equipment, thus posing the question of their true worth. Is the essence of effort so easily substituted by financial resources?

The quest to answer this question is pivotal for the fabric of modern society as well as the realm of blockchains. Indeed, it is a common belief that blockchains operate optimally when users with more money implicate their wealth to secure blockchains. We contest this folklore wisdom, advocating for blockchains operated via effort or, in machine language, computational power; the so-called Proof-of-Work (PoW). Put simply, we argue that blockchains, much like our bodies, are more secure with “work”.

Delving into the foundations of blockchains, two properties prevail as their backbone 1: safety, ensuring that transactions confirmed by an honest node will be eventually confirmed by all honest nodes, and liveness, guaranteeing that a transaction that is provided to honest nodes for a long enough period of time will be eventually confirmed by all honest nodes. These properties ensure that blockchains produce an ordered sequence of transactions, commonly known as a transaction ledger, which is immutable and keeps making progress.

Bitcoin made blockchains possible in a permissionless and dynamic network where parties can join and leave at will at any point in time without fulfilling any requirements. Newly joining nodes can trustlessly verify the correctness of the transaction ledger, given they connect to at least one honest node when bootstrapping in the network. In other words, when a node joins the Bitcoin network, they may receive several different versions of the ledger (i.e., different transaction orderings), but they can locally identify the “correct one” as long as it is among the received ones. Note that by “correct one” we mean the transaction order that the honest nodes in the system have agreed upon so far. This ability safeguards the transaction order integrity, the manifestation of safety in a dynamic, permissionless network.

To achieve this strong property, Bitcoin leverages PoW to elect block proposers in a fair, unbiasable manner and adopts the longest chain selection rule to determine which chain is the “correct one”. PoW effectively secures the blockchain against adversaries that control less than 50% of the computational power of the entire system. Coupled with the longest chain selection rule, PoW allows newly joining nodes to identify which of the received versions of the ledger holds more work and accept it as the “correct one”.

Alternative approaches to PoW have been proposed, where the block proposer election is proportional to the amount of coins (i.e., stake) one owns within the system (e.g., 2). This mechanism is known as Proof-of-Stake (PoS), and it is usually coupled with the longest chain selection rule, akin to the one of PoW. Although these approaches seem similar, PoS is vulnerable to safety attacks when the network is dynamic.

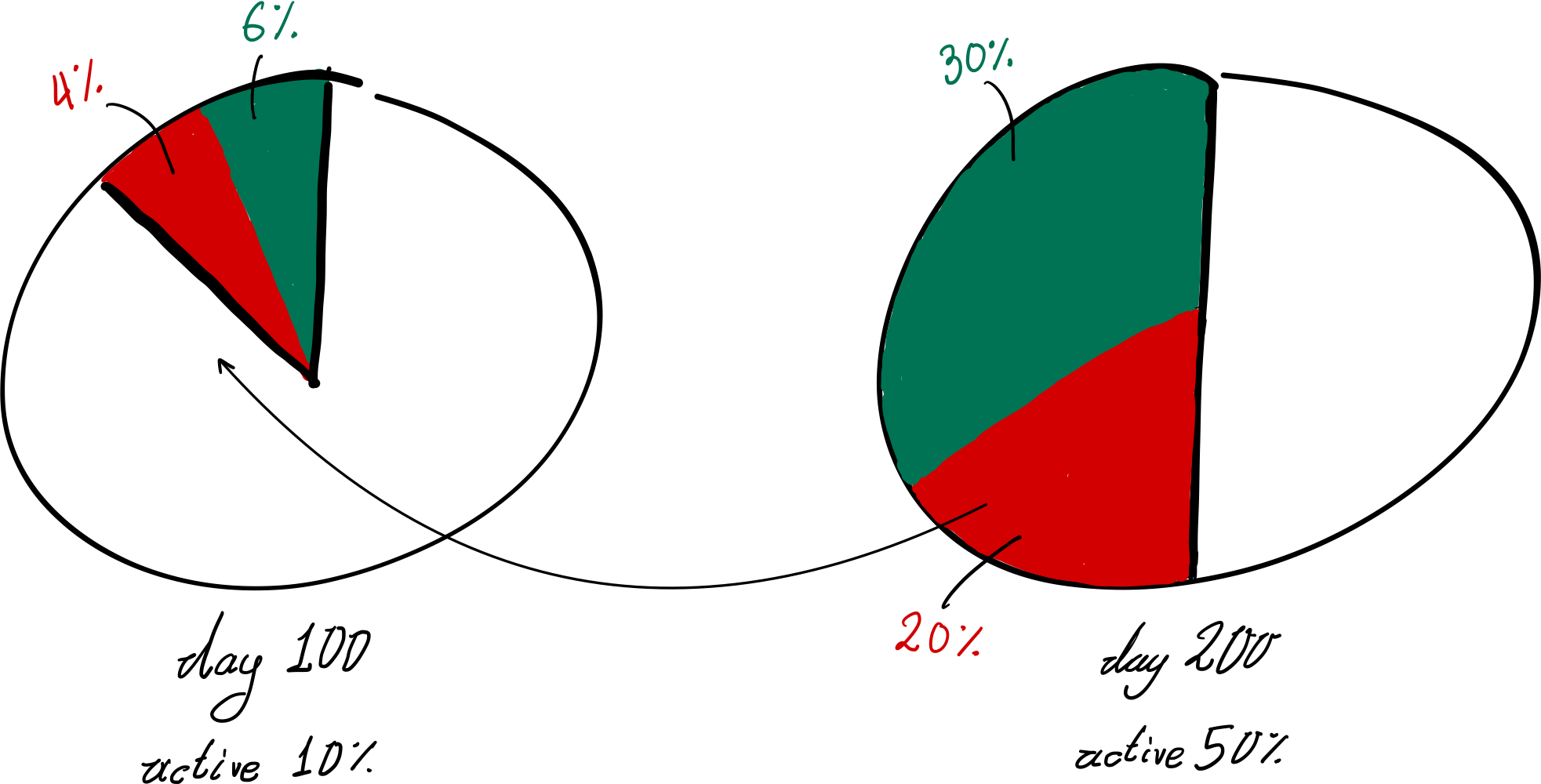

Let us illustrate this vulnerability with an example. Consider a PoS blockchain that, in its 100th operation day, has 10% of its total stake active, with honest nodes holding 6% and an adversary holding 4%. Then, at a later point in time, e.g., on its 200th operation day, the total stake active is 50%, with honest nodes holding 30% and the adversary 20%. On the 200th operation day, the blockchain is not safe anymore, as the adversary can now use its 20% stake to rewrite a posteriori the transaction order of the blockchain. This is feasible because the adversary’s current controlling share is 20% of the total stake in the system and can thus outpower the old 10% of total active stake: adversarial block proposers corresponding to that 20% simply need to sign fake past blocks and forge a longer chain, thus fooling newly joining nodes to choose it as the “correct one”. Remarkably, the attacker can break the security of the blockchain swiftly and at no cost, as no effort is required.

In essence, PoW blockchains function similarly to building a structure, while PoS resemble the process of buying land. Given the funds, the former demands a cumulative amount of work, whereas the latter requires effortless signatures. As such, the safety of pure PoS systems is predicated on the adversary controlling a minority of active stake comparatively to any point in time, including the past.

This class of attacks, referred to as posterior attacks, are feasible because the adversary can retroactively create past blocks. The crux of this vulnerability is thus the absence of an “arrow of time”, i.e., a temporal structure that prevents tampering with the past. This arrow of time is inherently enforced by the very same nature of PoW but lacks in PoS. To impose an artificial arrow of time, at a much lesser cost than PoW, recent works propose to couple PoS with Verifiable Delay Functions (VDFs), i.e., functions that force users to perform sequential and non-parallelizable operations 3 4 5.

With the use of VDFs, PoS blockchains can defend against posterior safety attacks in dynamic settings. Still, the security of PoS protocols employing VDFs does not match those of PoW. For example, imagine if Satoshi Nakamoto bootstrapped Bitcoin in 2009 and, at that point, they controlled more than 50% of the power invested in Bitcoin (a very reasonable assumption!). Today, Satoshi most probably cannot override the Bitcoin blockchain (i.e., replace it with a longer one), as this would entail them maintaining the majority of power, on average, throughout the execution of Bitcoin (from 2009 until now). Let us now imagine the same scenario in a PoS-VDF blockchain where the entity that bootstraps the protocol has an initial advantage and can privately create an alternative blockchain. In fact, PoS blockchains typically bootstrap in a centralized manner where the “creator” controls 100% of the circulating coins. For how long shall this entity maintain more than 50% of the stake to successfully fool newly joining nodes at a later point in time? Alarmingly, a single moment of majority control is sufficient to compromise safety, as the creator could initiate a private blockchain from the genesis block, always controlling over 50% of the stake. The integration of VDFs in PoS blockchains fails to safeguard them against attacks where an attacker with a temporary majority creates a private blockchain in parallel to the “correct” one.

Notably, the difference between these protocols is the cumulative nature of PoW versus the non-cumulative nature of VDFs. The question that arises is thus: can one create a blockchain that is equally secure in a dynamic network as Bitcoin but without relying on cumulative work? We assert that the answer to this question is no. To capture the fundamental difference across these mechanisms, consider the following thought experiment: Given the key pair that will win the lottery for proposing the next block, what is the required computational overhead to actually produce the next block?

In the context of PoW, knowing the winning public key in advance does little to alleviate the computational workload; the system must still undergo the same computational waste to identify the correct nonce. Conversely, in PoS blockchains that integrate VDFs, the computational overhead is reduced to executing the VDF with the pre-identified winning key. In a pure PoS blockchain, this process is merely a constant operation. We posit that this theoretical exercise constitutes a separator among such mechanisms, encapsulating the essence of their safety in dynamic networks; demonstrating how (proof of) work prevails in blockchains as it does in nature.

Acknowledgments:

We thank Giulia Scaffino for her valuable feedback on this post.

References

- Juan A. Garay, Aggelos Kiayias, Nikos Leonardos. “The Bitcoin Backbone Protocol: Analysis and Applications.” Journal of the ACM (to appear), 2024. https://eprint.iacr.org/2014/765.pdf.

- Aggelos Kiayias, Alexander Russell, Bernardo David, Roman Oliynykov. “Ouroboros: A provably secure proof-of-stake blockchain protocol.” In Annual international cryptology conference, pp. 357–388, 2017. Springer. https://eprint.iacr.org/2016/889.pdf.

- Dan Boneh, Joseph Bonneau, Benedikt Bünz, Ben Fisch. “Verifiable delay functions.” In Annual international cryptology conference, pp. 757–788, 2018. Springer. https://eprint.iacr.org/2018/601.pdf.

- Benjamin Wesolowski. “Efficient verifiable delay functions.” In Advances in Cryptology–EUROCRYPT 2019: 38th Annual International Conference on the Theory and Applications of Cryptographic Techniques, Darmstadt, Germany, May 19–23, 2019, Proceedings, Part III 38, pp. 379–407, 2019. Springer. https://eprint.iacr.org/2018/623.pdf.

- Krzysztof Pietrzak. “Simple verifiable delay functions.” In 10th innovations in theoretical computer science conference (itcs 2019), 2019. Schloss-Dagstuhl-Leibniz Zentrum für Informatik. https://eprint.iacr.org/2018/627.pdf.